Top retail bank in Southeast Asia improves marketing efficiency

- Lead scoring

- Lead acquisition

- Web personalization

- Ad performance optimization

- Banking

- Financial services

- Insurance

About the client

The client is one of the largest retail banks in Southeast Asia, which has a strong presence in Indonesia with over 1,200 branches and 17,000 ATMs nationwide, providing banking services to individuals and businesses alike. The bank offers a wide range of products and services, including savings and deposit accounts, credit cards, loans, and insurance, among others.

The client has also been at the forefront of adopting digital technologies to enhance customer experience, launching a mobile banking app and Internet banking services. With a strong focus on customer satisfaction and innovative offerings, our client has been recognized as one of the most trusted banks in Indonesia.

Client’s challenges

The client was not only challenged by upcoming fintech rivals who are agile in offering alternative banking options through seamless digital experience but also by resetting consumers' expectations on speed and omnichannel experience. With a fragmented customer journey across online and offline touchpoints and across the client’s website ecosystem, the bank experienced challenges in understanding customers’ preferences and needs to optimize their experience and, all the while, complying with strict data & security regulations that the financial sector faces.

Opportunities

Adopting a CDP with a flexible architecture instead of building a solution internally would save the bank substantial resources while still enabling compliance with data protection regulations.

A great deal of incremental revenue could be unlocked through reengaging website visitors, both known and anonymous customers, across marketing channels with personalized offers.

A CDP would provide the tools to structure, analyze and activate customer data, turning the abundance of unorganized data into a sea of opportunities to generate more revenue and keep up with a fast-paced digital transformation.

A CDP would provide the tools to structure, analyze and activate customer data, turning the abundance of unorganized data into a sea of opportunities to generate more revenue and keep up with a fast-paced digital transformation.

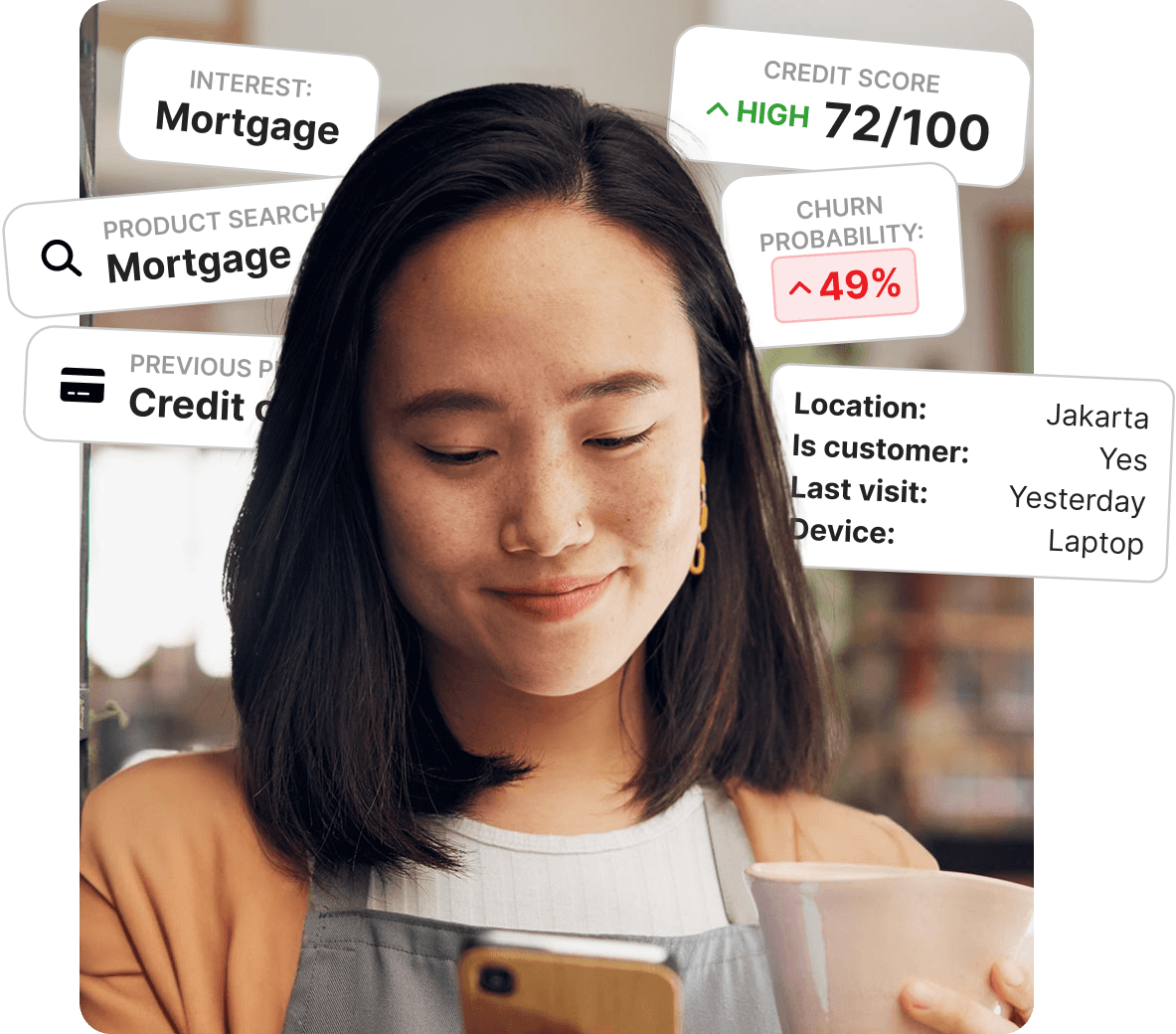

With access to consolidated customer profiles, the bank could identify the needs and demands of its customers and offer more relevant products and services, creating an opportunity for cross-selling and upselling.

Adopting CDP would transform the bank’s digital strategy and move the brand higher on the maturity ladder of innovation and user addressability, helping stay competitive in the rapidly changing industry.

Solutions delivered by Meiro

Flexible hosting and customizable architecture

First of all, the CDP had to be hosted on-premise and behind a firewall to comply with data residency and data security requirements of the Indonesian Data Protection regulations.

Meiro built local storage between the bank’s general ledger containing especially sensitive data and CDP conforming to the bank’s security requirements.

Cross-domain tracking and consolidation of customer data

Meiro set up an ETL layer for data processing, data collection, transformation, and standardization required for the production of clean data. Meiro created Digital Command Center over 3 mobile apps, websites, and an internal customer database consolidating data from 15 sources to create unified customer profiles.

Then, Meiro unified transactional and behavioral customer data and made it available for activation and analytics by business users.

Meiro set up an overview of all digital marketing activities for campaign reporting in 45 days. We aggregated reports from 13 activation channels (social media, performance ads, agencies, etc.).

Optimizing marketing efforts with personalized experiences

The sophisticated identity tracking brought by Meiro CDP made it possible to hyper-personalize content for and reengage with users even without knowing their PII data. Personalized native web banners were set up aimed to target anonymous website visitors, collect their PII and convert them to leads.

Meiro treats the project as a managed service since the client’s marketing department doesn’t have in-house analysts. Meiro, as a consultant, created data-led digital marketing strategies and redesigned campaign logic, reporting, and benchmarking.

Identity resolution and single customer view

Meiro’s customized identity management for the client’s needs. This enabled tracking and matching customer profiles based on 1st-party Meiro SDK IDs and 3rd-party such as FB Client ID, TradeDesk ID, Google Client ID, etc. This helped to consolidate cross-device and cross-channel data (online and offline) by stitching them with existing customer profiles.

After the holistic tracking system was in place, Meiro enabled visibility into the customer journey — the client’s team could now clearly see the exact level of customer engagement across different touchpoints and their stage in the marketing funnel. Business users now could leverage unified customer profiles for granular segmentation, personalized activation, and analytics.

Impact:

The client also saved 140 hours/month in data reporting with near-to-real-time reporting on campaign performance and customer behavior across 15 different data sources.

Meiro web banners collect 30% of new leads yielding a business value of 72 Billion IDR.

Performance of direct marketing campaigns improved by 238% for Email, Web and in-App messages.

The client saved over 1 Billion IDR since it replaced its legacy solution for pop-ups with Meiro’s native web banners.

Meiro’s native web banners deliver 50% more impressions and clicks than the previous solution due to precise segmentation and personalization.

Ads are 6% more relevant after CDP implementation

Click Through Rates improved by 160% for advertising campaigns

Advertising budgets are 10% more efficient than before with personalized retargeting based on longer-lasting 1st-party customer identities.

The bank has been steadily increasing its targetable audience reach by 50% every year with Meiro’s identity resolution.

Cost Per Acquisition has improved 5 times due to better segmentation and targeting.

Looking for ways to improve campaign performance, find new customers, and drive revenue?

Look no further — unleash the full potential of your customer data with Meiro.