CDP for banking, financial services, and insurance

Designed for regulated industries, Meiro enables the delivery of personalized, omnichannel marketing experiences while ensuring compliance with data residency and sovereignty requirements.

Problems we came here to solve

Fragmented customer identity

Fragmented customer identityOur identity resolution connects customer interaction across devices and any other touchpoints online and offline, providing a single view of customers and their journeys, ultimately driving revenue growth through enhanced precision and addressability.

Technical data silos

Technical data silosOur CDP addresses the challenge of fragmented customer data by unifying data from various systems like CRM, POS, and advertising platforms, enabling complete customer views and enhancing marketing efficiency.

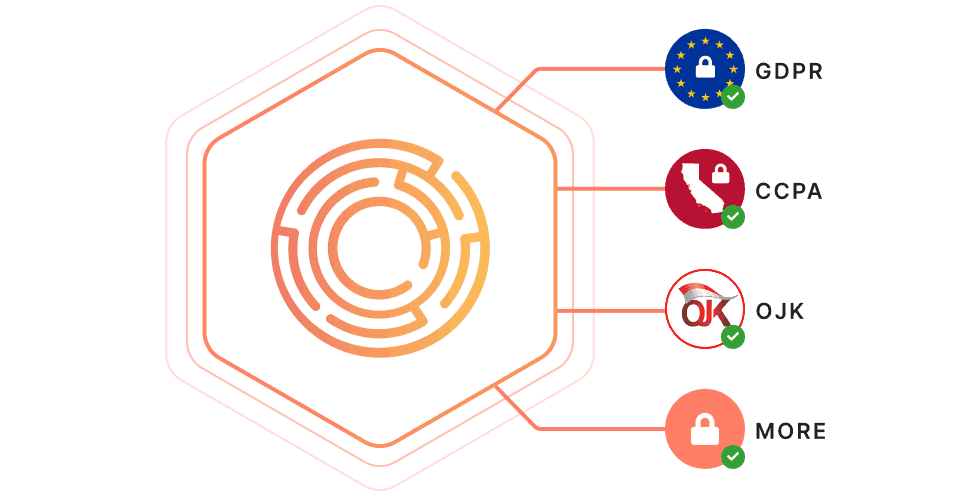

Data privacy regulations

Data privacy regulationsWith increasing data localization and control demands, SaaS adoption is challenging. Our CDP offers flexible deployment options, enabling you to store data on your servers or within specific countries based on your business needs.

Success story from Indonesia’s top retail bank

yearly since onboarding Meiro CDP

due to segmentation and personalization

more leads with business value of 72 Billion IDR

Client’s challenges & Meiro’s solutions:

Client could not re-engage anonymous returning web visitors with relevant offers.

Removed all obstacles in identity management, enabling retargeting and personalization for anonymous web visitors.

Could not consolidate customer journey across different touchpoints, apps and business units.

Unified customer data across 15 data sources, unlocking single view into customer journey across channels.

Marketing & comms department relied on a busy engineering team for building audience segments, compromising effectiveness of marketing initiatives.

Enabled marketing department with no-code audience segmentation saving 140 hours/month in data segmentation & reporting.

Strict data privacy & security regulations for financial sector limits types of data they can analyze for insights and personalization.

Meiro CDP is hosted on-premise and adapts to the client’s architecture requirement to meet industry regulations.

What banks and financial services love about Meiro CDP

Stay regulation-proof

Meiro addresses regulatory compliance challenges by providing transparent architecture and flexible hosting, empowering clients with control over their data and technology stack. Meiro CDP can be deployed on-premise or on any major cloud, ensuring compliance with local data residency requirements in any country worldwide.

Eliminate data silos

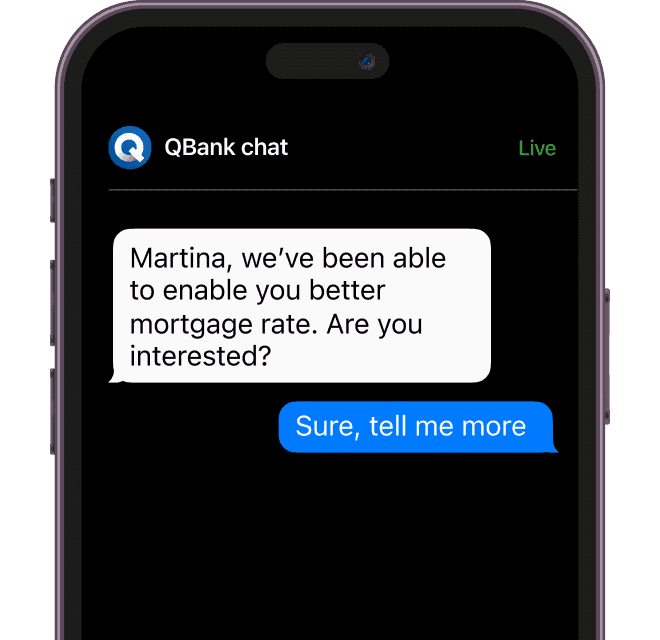

Our CDP collects and consolidates customer data from multiple online and offline touchpoints, tools, internal systems, and business units, creating real-time golden records of customers. This comprehensive view of customer journeys enables prediction, analysis, attribution, personalization of customer experience, and optimization of marketing campaigns.

Segment audiences fast

Meiro democratizes access to customer data for business users, empowering them with autonomy from overburdened IT teams. Leverage insights into customer’s journey stage and affinities to deliver timely personalized marketing campaigns that delight and convert without a single line of code.

Learn more about Smart Segmentation

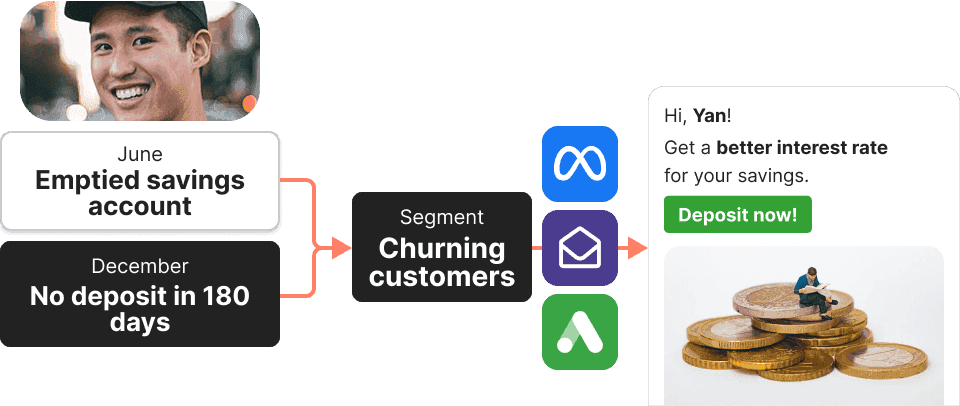

Nurture customer loyalty and prevent churn

Meiro consolidates transactional and behavioral signals from various sources, providing the bank's team with insights about patterns that indicate a customer's likelihood to churn. This knowledge enables the bank to take immediate proactive measures to retain customers who are at risk of churning.

Seamlessly connect to internal systems

Besides the bespoke customizable analytics & dashboard solution built into Meiro CDP, we also provide seamless integrations of any customer or performance data gathered in the CDP into the client's preferred systems or tools such as CRM, master data warehouse, BI, Data Science and ML platforms, and more.

CDP use cases for banking, financial services and insurance

Improve customer acquisition

Retarget returning anonymous web visitors with personalized content to improve likelihood of conversion.

Learn more

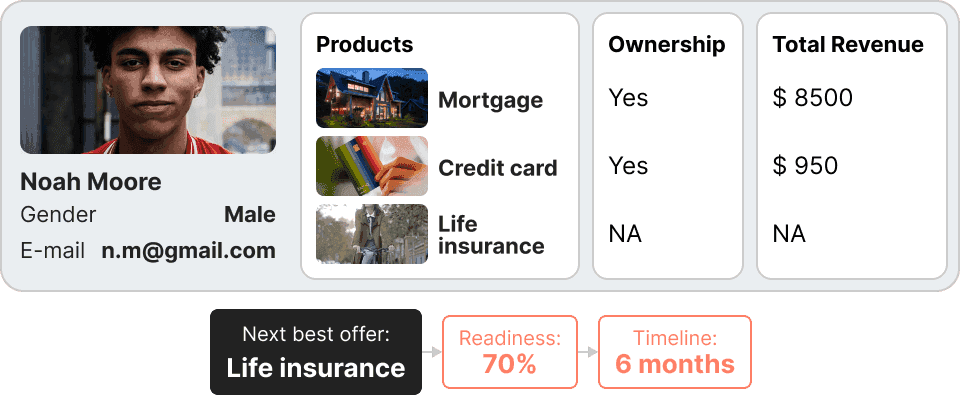

Next-Best-Offer (NBO)

Identify customer affinity and propensity for product adoption by analyzing and activating cross-device and cross-channel user behavior.

Learn more

Churn management

Leverage behavior signals from multiple devices to create rich customer identity and offer your customers only the most relevant products.

Learn more

Here’s how Meiro is different from other CDPs

Wall-to-wall approach

From data integration, cleaning, and management to omnichannel marketing activation — get all in one and achieve faster time-to-value without rebuilding your MarTech stack or setting up any additional infrastructure.

Flexible delivery model

For security-driven clients required to comply with local data residency regulations, we offer single-tenant solutions for private hosting in every major cloud or on-premise anywhere in the world.

Built to adapt and grow with you

Meiro CDP is a transparent, flexible, and scalable solution that seamlessly integrates with the client’s tech stack and existing internal systems, promoting efficiency, security, and data control.

Ease of use

Business users gain autonomy from overburdened IT teams with no-code audience segmentation and comprehensible customer insights available for immediate marketing activation and analytics.